Get free consultation

Fill out the form and we will contact you

Property tax in the United States, also known as real estate tax, is an important levy that every property owner in the U.S. must deal with. It is not only a primary source of revenue for local governments but also directly affects living costs and real estate investment decisions. In the 2025 economic context, with stable inflation and rising home prices in certain areas, understanding U.S. property tax has become essential, especially for Vietnamese individuals considering settlement, home purchase, or investment there. This article provides a comprehensive overview of U.S. property tax, from basic definitions and detailed calculation methods to tax rates by state, helping you optimize costs, avoid common mistakes, and plan your finances more effectively..

Property tax in the United States is an annual tax that property owners must pay to local governments, including counties, cities, school districts, and sometimes special agencies such as park or library authorities. Unlike federal income tax, which is administered by the Internal Revenue Service (IRS), property tax is primarily used to fund essential public services such as education, roads, police, fire protection, and public health. According to the Tax Foundation, it is the second-largest source of local government revenue—after sales tax—and accounts for about 30% of local budgets in many areas.

In the United States, all types of real estate are subject to property tax—from single-family homes and condominiums to rental properties, farmland, and commercial real estate. However, the tax rate is not determined by the federal government but entirely depends on each state and local jurisdiction. For example, in California, property tax has been limited by Proposition 13 since 1978, which allows a maximum annual increase of only 2% based on the property’s original purchase value. This protects homeowners from sudden spikes but also results in uneven tax levels between older and newer properties. In contrast, states like Texas impose higher property taxes to compensate for the absence of a state income tax.

For new homeowners, property tax is often included in the monthly mortgage payment through an escrow account managed by the bank, helping to prevent tax debt accumulation and penalty interest. If payments are not made on time, homeowners may face high interest penalties (typically 1–2% per month) or even lose their property through foreclosure. In 2025, with the national median home price around $400,000, property tax represents a significant expense—especially in major cities like New York and San Francisco, where annual tax bills can exceed $10,000. Understanding this concept not only helps with budgeting but also assists in choosing a suitable place to live.

Calculating property tax in the United States is not overly complicated but requires a clear understanding of several key factors, including property value, tax rate, and local adjustments. The basic formula is: Annual Tax = Assessed Value × Tax Rate.

Assessed Value: This is the property’s value determined by the local assessor’s office, usually based on its actual market value but sometimes calculated as a certain percentage of it (known as the assessment ratio). For example, in some states like New York, the assessed value may represent only 80–100% of the market value and is periodically reassessed—either annually or every few years, depending on local regulations. Homeowners have the right to appeal if they believe the assessed value is inflated, and according to reports from reAlpha, the success rate for such appeals is typically around 30–40%.

Tax Rate (or Millage Rate): This refers to the percentage or “mill” rate applied to the assessed value (1 mill = 0.1% or $1 per $1,000 of assessed value). The rate is set by local governing bodies based on the budget required for public services. For instance, if the millage rate is 20 mills, you would pay $20 in property tax for every $1,000 of assessed value. In 2025, tax rates may see slight increases in certain areas due to inflation and higher budget demands, although several states, such as Colorado, have implemented dual assessment rates to help ease the burden on residential properties.

Let’s take a specific example to illustrate: Suppose a home in Texas has a market value of $300,000, an assessed value of 100% ($300,000), and a tax rate of 1.58%. The annual property tax would be $300,000 × 0.0158 = $4,740. You can use online tools such as the property tax calculators on SmartAsset or Zillow to get a more accurate estimate based on the exact address. In New York City, property tax is calculated based on property classes (Class 1 for single-family homes, with a rate of 20.085% in 2025), making the process more complex but still following the same basic formula. Understanding how this calculation works helps you anticipate expenses and prepare for annual adjustments.

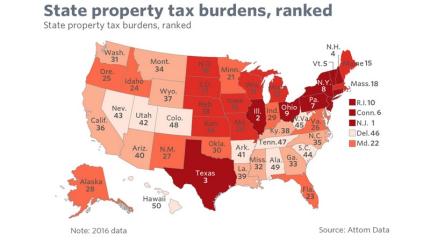

Property tax rates in the United trStates vary significantly across states, depending on real estate values, local budget needs, and overall tax policies. According to 2025 data from WalletHub and the Tax Foundation, the national average effective property tax rate is around 1.0–1.22% of a property’s value, with median property tax bills ranging from about $600 in Alabama to over $9,000 in New Jersey. Nationwide, the average property tax bill for a single-family home has increased by approximately 4.1% compared to the previous year, reaching around $1,889 per county.

Below is a ranking of several states with the highest and lowest property tax rates in 2025 (based on effective tax rate and average tax bill):

Northeastern states such as New Jersey and Connecticut typically have higher property taxes due to substantial education and infrastructure costs, while Southern and Western states like Alabama or Hawaii tend to have lower rates thanks to favorable tax policies and higher property values that offset revenue needs. In Texas, although there is no state income tax, the property tax rate is relatively high (around 1.58%) to balance the state budget. In 2025, some states like Montana have adopted a tiered tax rate system—0.76% for the first $400,000 in property value and higher rates for the remaining amount—to ease the burden on small homeowners. Additionally, in major cities, property taxes can exceed state averages; for example, in New York City, the average annual bill is $9,937.

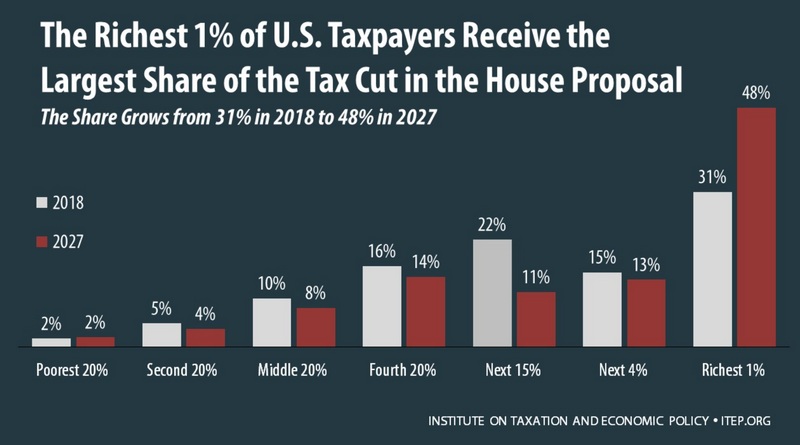

American homeowners can reduce their tax burden through various exemption and deduction programs. The most common is the Homestead Exemption, which lowers the assessed value of a primary residence and can save homeowners an average of about $950 per year in some counties, such as Cook County, Illinois. In 2025, the IRS allows property tax deductions of up to $10,000 for individuals or $20,000 for married couples filing jointly as an itemized deduction on federal tax returns, under the extended Tax Cuts and Jobs Act (TCJA).

For Seniors and People with Disabilities: Many states offer additional property tax exemptions for individuals aged 65 and older or those with disabilities. For example, New York provides up to a $50,000 reduction in assessed value for senior citizens.

For Veterans: Special exemptions are available for veterans, particularly those with service-related disabilities, and can reach up to 100% in some states.

Renewable Energy: A federal tax credit of up to $3,200 is available for energy-efficient home improvements, such as installing solar panels, and remains in effect through 2025.

Mortgage Interest Deduction: Alongside property tax deductions, homeowners may also deduct mortgage interest payments within certain limits.h.

In 2025, new tax reforms under the Trump administration—such as reducing the tax-exempt bond threshold from 50% to 25%—may indirectly affect property taxes. Homeowners are advised to check with their local assessor’s office to take advantage of applicable programs and to file an appeal if their tax bill increases unreasonably—a step that could save thousands of dollars.

Property tax in the United States is typically paid twice a year or quarterly, either through banks, online platforms, or directly at the local tax office. For homeowners with a mortgage, payments are usually collected through an escrow account to ensure they are made on time. To save money, it’s advisable to review annual property assessments and file an appeal if necessary; experts recommend hiring a tax attorney if the disputed amount is substantial.

For Vietnamese buyers purchasing homes in the United States, it’s wise to prioritize states with lower property taxes—such as Hawaii or Alabama—to minimize long-term costs. However, it’s important to also consider public services, as higher taxes often correlate with better schools and greater safety. Additionally, keep track of 2025 tax changes, such as inflation adjustments from the IRS, which have raised the standard deduction to $15,750 for individuals. Tools like TurboTax can help accurately calculate eligible deductions.

Property tax in the United States is a crucial factor influencing both daily life and real estate investment. With an average rate of 1.22% in 2025, understanding how it is calculated, the differences among states, and available exemptions can help you save significantly and avoid financial surprises. If you are planning to buy a home or settle in the U.S., consider consulting local tax professionals or trusted sources such as the IRS and the Tax Foundation for the latest updates. Hopefully, this article from Second Citizenship has provided you with valuable insights about U.S. property tax, feel free to share your experiences in the comments section to continue the discussion!

Fill out the form and we will contact you